Sacombank Internet Banking is an electronic banking service of Saigon Thuong Tin Commercial Joint Stock Bank. Allow users to transfer money, pay bills, save money, look up account balances 24/7 without having to go directly to transaction points.

Sacombank mBanking for Android Sacombank mBanking for iOS

However, to use this online bank, users need to register for Sacombank's Internet banking service. Then experience the convenient features that this service offers. Invite you to follow the article below to know how to do:

How to register for Internet Banking service of Sacombank

Only need to be 15 years old, have a payment account at Sacombank to register for Internet Banking service. At that time, customers need to bring the original ID / Passport to the transaction counters for comparison, then follow the instructions of the staff. IBanking Sacombank registration fee is VND 0, maintenance fee is VND 40,000 / quarter (free of charge for the first quarter).

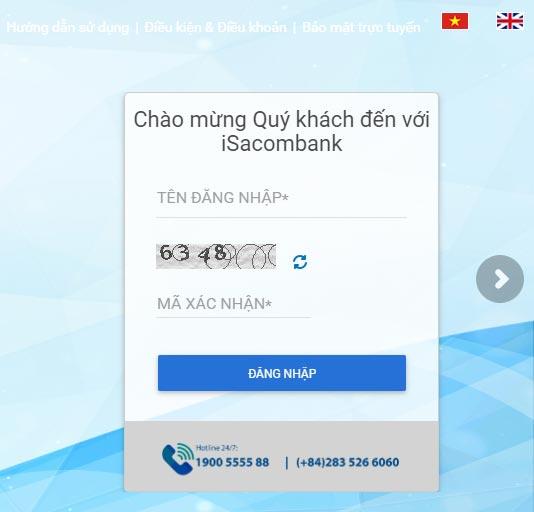

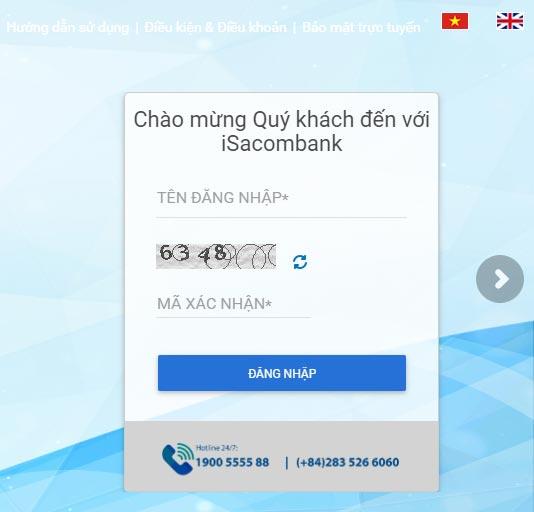

After successful registration at the counter, the bank will issue an account with username and password. Users access Sacombank's Internet banking homepage and log in with this account.

Instruction for using Sacombank Internet Banking service

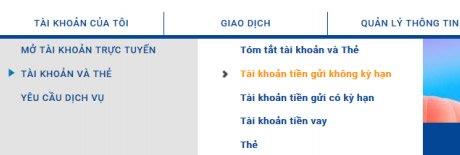

Checking account balance

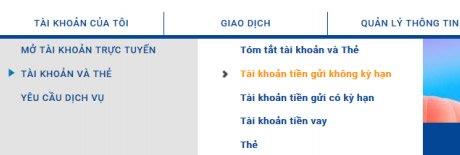

To view account balances, click the My Account tab > Accounts and Cards , select the account type to check:

- Demand deposit account.

- Term deposit account.

- Loan account.

- Card account.

To view account details, click on the account number to view, then click on the (...) in the right corner of the screen to view the following

contents: Transaction history, Check Czech issued, View recent transactions Most, View blockade transactions, View transaction statements.

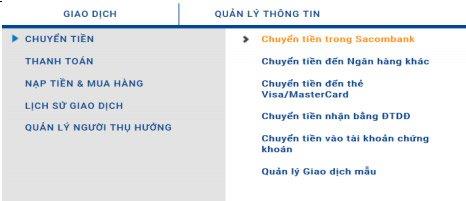

Online transfer

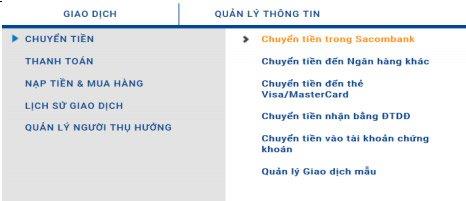

To transfer money via Internet Banking Sacombank, select the Transaction tab on the toolbar, then select the appropriate feature:

- Transfer money within the system: Transfer to an account with the bank or receive by ID / Passport. Free money transfer with other provinces, money transfer in other provinces / cities is VND 8,000.

- Transfer money outside the system: Transfer to other bank accounts or receive by ID / Passport, transfer money to card number. Fee for transferring money outside the same system in the province is 0.018%, in other provinces it is 0.041% (at least VND 25,000).

- Transfer - receive by mobile phone: Transfer money to relatives and withdraw money at ATM without card. Transfer fee of VND 8,000 / transaction.

- Transfer money to Visa / MasterCard: Transfer fee 15,000 VND / transaction.

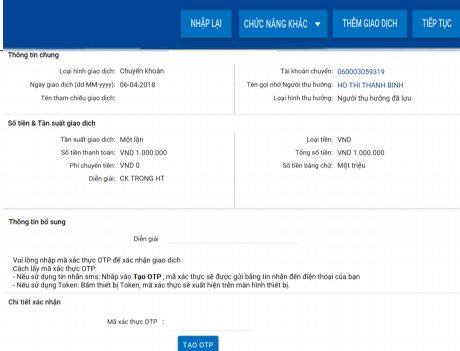

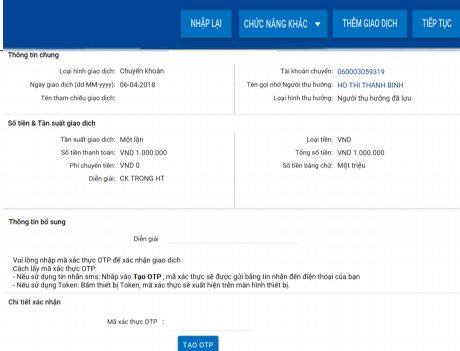

Note: When transferring money to a card number, you need to enter the correct card number to receive Token code (encryption of card number). To receive OTP code, click on the initialization box next to it (Sacombank does not automatically send OTP as other banks).

Online savings deposit

To deposit online, select the Account tab in the toolbar. Then select the term deposit and click Open online deposit account . Complete information and confirm sending before receiving OTP code to complete the transaction.

Note:

- Minimum deposit of 1 million.

- Interest payment method at the beginning of the period, monthly or ending period is optional.

- Flexible deposit term, interest rate is displayed by corresponding term.

With Sacombank iBanking, you can easily conduct online banking anytime, anywhere, including outside office hours as well as holidays.

I wish you successful implementation!