Below is an online tax calculator, online personal income tax calculator so you can get the results immediately without having to do complicated calculations. We will fill in all the required salary information in the calculator, fill in the number of dependents if any and press calculate to get the tax rate you have to pay this year.

How to calculate personal income tax by month, by year

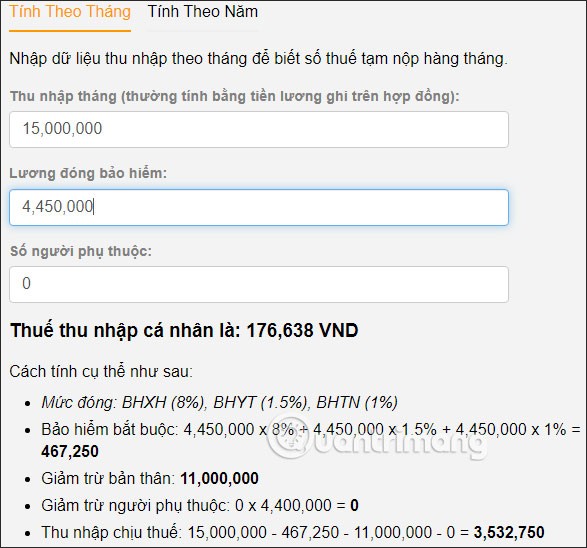

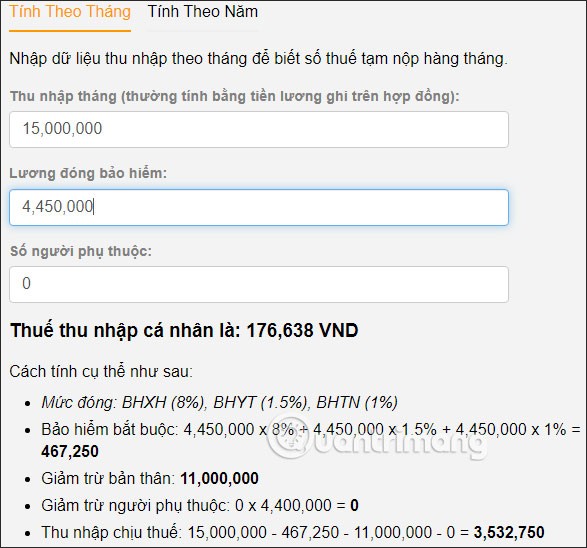

Enter your income data including total taxable income, insurance-paying salary and number of dependents in the box below to calculate the income tax payable:

Table of Contents of the Article

Tool to quickly calculate personal income tax online

Enter your total income, insurance salary, and number of dependents in the box below to see the tax payable.

- Social insurance (8%), health insurance (1.5%), unemployment insurance (1%) ⇒ Compulsory insurance = Salary for insurance contribution * (8% + 1.5% + 1%)

- Personal deduction: 11,000,000 VND

- Dependent deduction: Number of dependents x 4,400,000 VND

The end of each year will be the time to settle personal income tax for each employee of businesses and companies. Calculating personal income tax for each person will be different, depending on many factors, from exempted income, subjects with family deductions, etc. Usually, employees will authorize the company to calculate taxes, but you can also calculate the amount of personal income tax you have to pay yourself, through the WebTech360 tool below. Users just enter their income amount and see the results.

Users can calculate income tax monthly or annually.

Calculate monthly income tax

You enter your monthly income, the amount of insurance to be paid, the number of dependents and then click Calculate Personal Income Tax .

The result will show the personal income tax amount, along with a detailed calculation formula.

Calculate personal income tax by year

By calculating personal income tax by year, users will know whether they are entitled to a refund or have to pay more. Fill in all the information as shown in the table below and then click Calculate Personal Income Tax .

Personal income tax calculation formula

In the table below, the abbreviation TN stands for monthly taxable income (after deducting insurance and family deductions).

| Level |

Monthly income |

Tax payable |

| 1 |

TN <=> |

TN x 5% |

| 2 |

5tr < tn=""><=> |

TN x 10% - 0.25 million |

| 3 |

10tr < tn="">><=> |

TN x 15% - 0.75 million |

| 4 |

18tr < tn=""> |

TN x 20% - 1.65 million |

| 5 |

32tr < tn=""><=> |

TN x 25% - 3.25 million |

| 6 |

52tr < tn=""><=> |

TN x 30% - 5.85 million |

| 7 |

TN > 80 million |

TN x 35% - 9.85 million |

Attention:

Each region has different regulations on the minimum salary for health insurance contributions. The above calculation is for region 1 (including major cities). For other regions, please refer to current regulations.

How to calculate the latest family deduction

According to the State's regulations, family deduction is the right of employees when they have dependents, who must be supported or cared for. The current family deduction level has also changed according to the new tax rate of the State.

Family deduction is the amount deducted from personal income taxable income before calculating tax on income from salaries and wages of taxpayers who are resident individuals.

Family deductions include the following two items:

- Family deduction for the taxpayer himself (this is a deduction that taxpayers who are resident individuals are naturally entitled to).

- Family deduction for dependents

Note, taxpayers are only allowed to deduct dependents if they have registered a tax code in accordance with regulations.

People with income below 11 million VND/month will not have to pay tax so there will be no family deduction.

The deduction for each dependent is 4.4 million VND/month. Each additional dependent will be deducted an additional 4.4 million VND/month.

When wanting to deduct family circumstances, taxpayers must register dependents according to the instructions below.

Each dependent is also provided with a tax identification number. You can look up your dependent's tax identification number yourself by following this article.

You can simply understand the tax calculation formula when having dependents with the example of a person earning 20 million VND and having 1 dependent.

First, you need to calculate the taxable income according to the formula: Salary received - 11 million VND - 4.4 million VND. Applying this formula, we will calculate the taxable income as:

20,000,000 – 11,000,000 – 4,400,000 = 4,600,000 (VND).

So from there we will know the tax payable of 4,600,000 is 4,600,000 * 5% = 230,0000 (VND) .