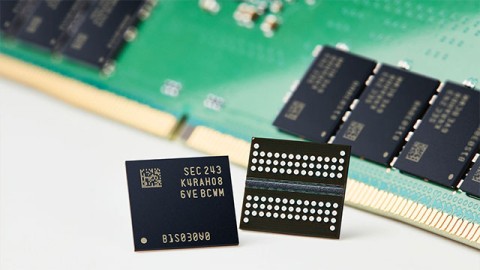

With the increasing demand and profits from HBM and DDR5 memory, major DRAM manufacturers in the market are preparing plans to completely stop producing DDR4 and DDR3 memory.

Last year, Samsung discontinued DDR3 memory due to a sharp decline in demand worldwide. While other major manufacturers have largely stopped producing DDR3, DDR4 is also set to follow suit this year. The DDR3 standard has been around for nearly 18 years, while DDR4 debuted in 2014. After dominating the mainstream consumer hardware market for more than a decade, DDR4 RAM technology is slowly reaching the end of its life cycle.

DDR5 has received a fairly good response since entering the mainstream consumer electronics market. As for DDR4, although it still has a larger market share than DDR5, its supply is expected to decline significantly in the second half of 2025. DigiTimes reported that due to the decline in demand and profits from DDR4 and DDR3 DRAM, major memory makers such as Samsung, Micron, and SK Hynix may completely stop producing these types of memory.

The decision also comes amid increased demand for HBM and DDR5 memory, which are in high demand in both the consumer and server markets. As the memory giants focus on delivering more and better DRAM chips to customers, they have shifted to DDR5 and HBM, leaving DDR3 and DDR4 to smaller manufacturers.

In terms of demand and supply of DDR4 and DDR3, they will still be in demand as the majority of users currently own systems using one of these two types of memory. Therefore, Chinese manufacturers like CXMT are looking to increase their global market share by expanding DDR4 production while simultaneously focusing on DDR5.

On the other hand, Taiwanese memory makers such as Nanya Technology and Winbond are also expected to fill the supply gap, meeting the demand of the DDR3/DDR4 market. Major players such as Samsung, Micron, and SK Hynix are expected to stop producing DDR3 and DDR4 in the second half of this year, which may cause some initial supply constraints. Meanwhile, high demand in the AI and cloud computing fields is driving them to mass produce high-speed memory chips such as HBM.